Expected Interest Rates In 2025 A Comprehensive Outlook

BlogWith enthusiasm, let’s navigate through the intriguing topic related to Expected Interest Rates in 2025: A Comprehensive Outlook. Let’s weave interesting information and offer fresh perspectives to the readers.

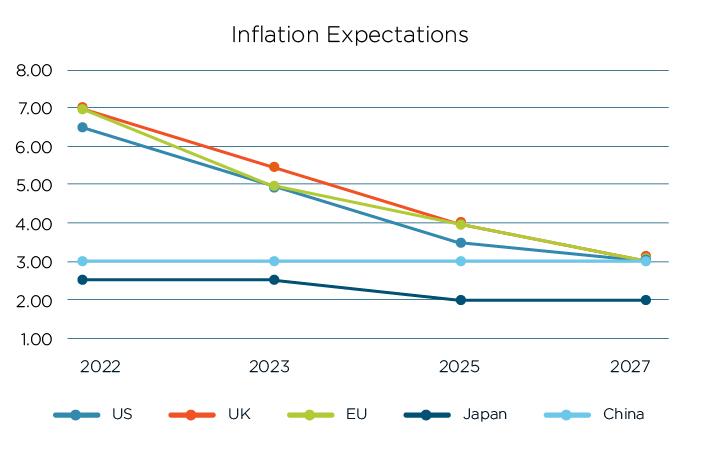

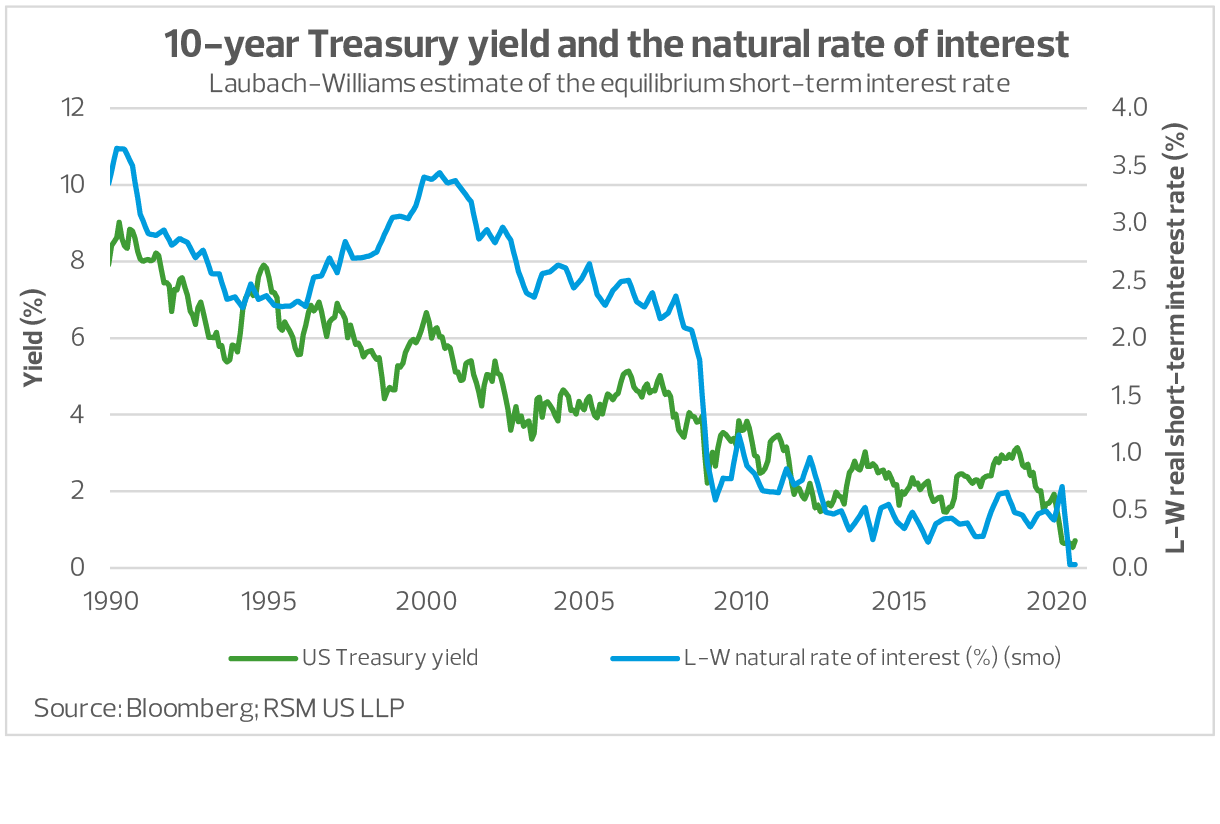

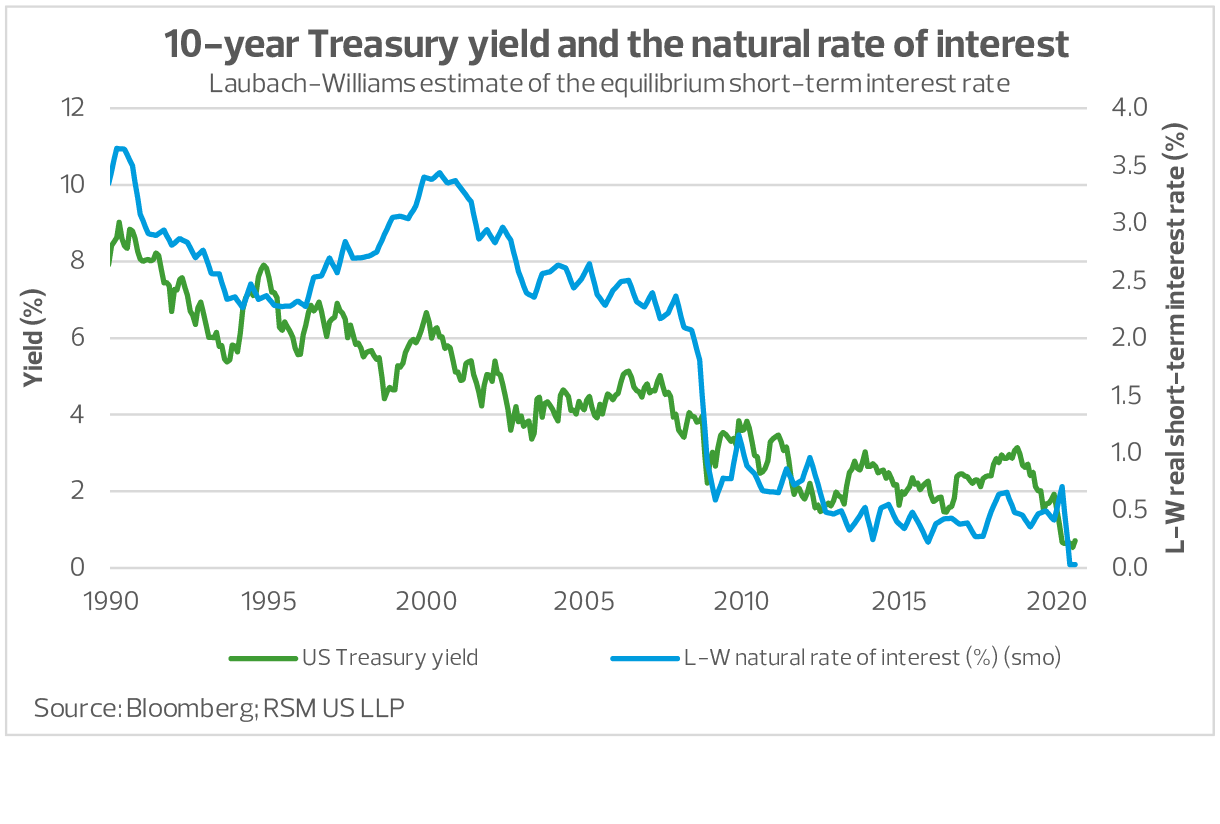

Interest rates play a pivotal role in the global economy, influencing investment decisions, consumption patterns, and economic growth. As we approach 2025, it becomes imperative to forecast expected interest rates to navigate the financial landscape effectively. This article provides a comprehensive outlook on the anticipated interest rate trajectory in 2025, considering various economic factors and expert projections.

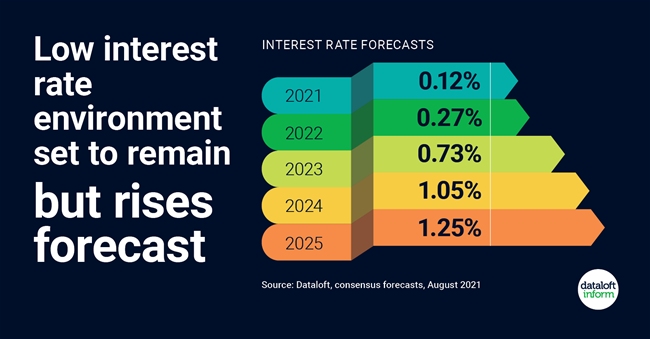

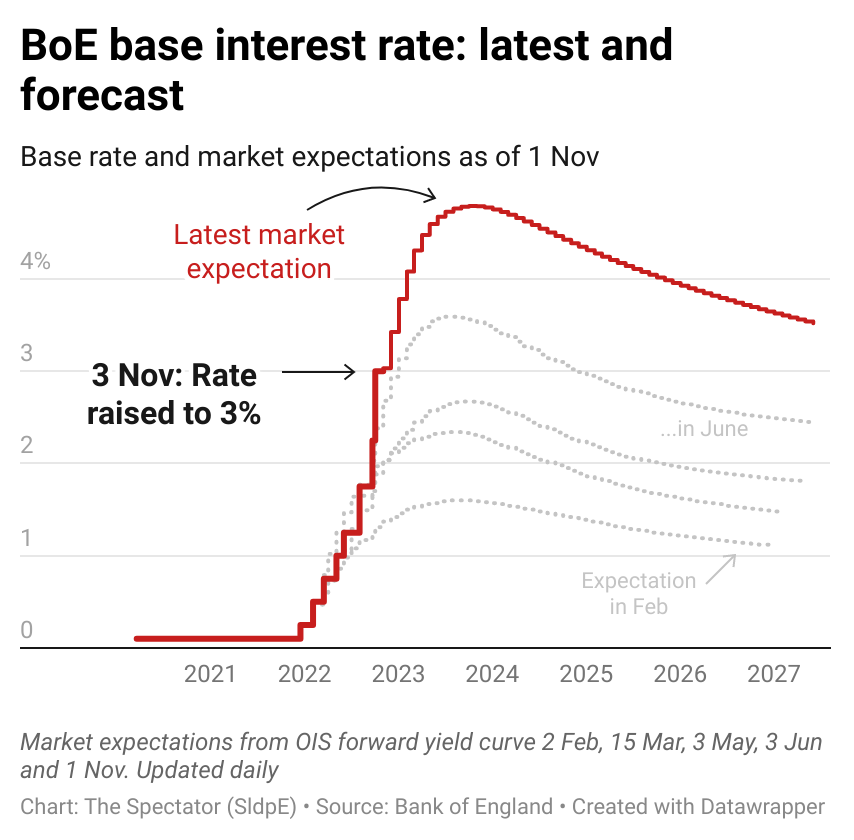

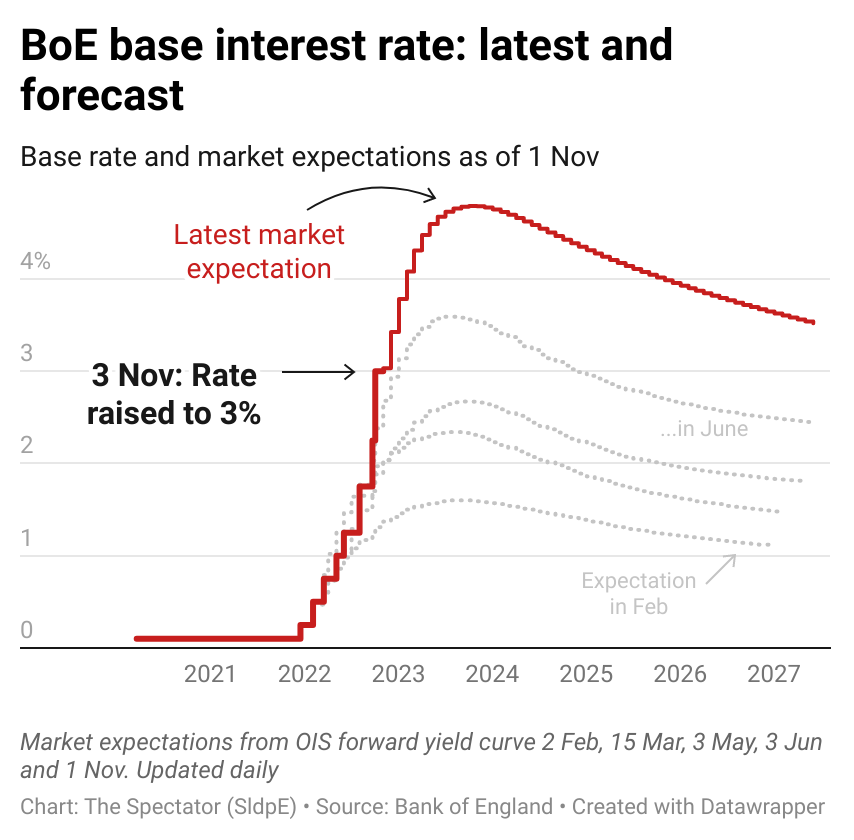

Currently, interest rates are at historically low levels due to the ongoing COVID-19 pandemic and accommodative monetary policies implemented by central banks worldwide. The Federal Reserve (Fed) has maintained its benchmark interest rate near zero, and the European Central Bank (ECB) has set its deposit rate at -0.5%.

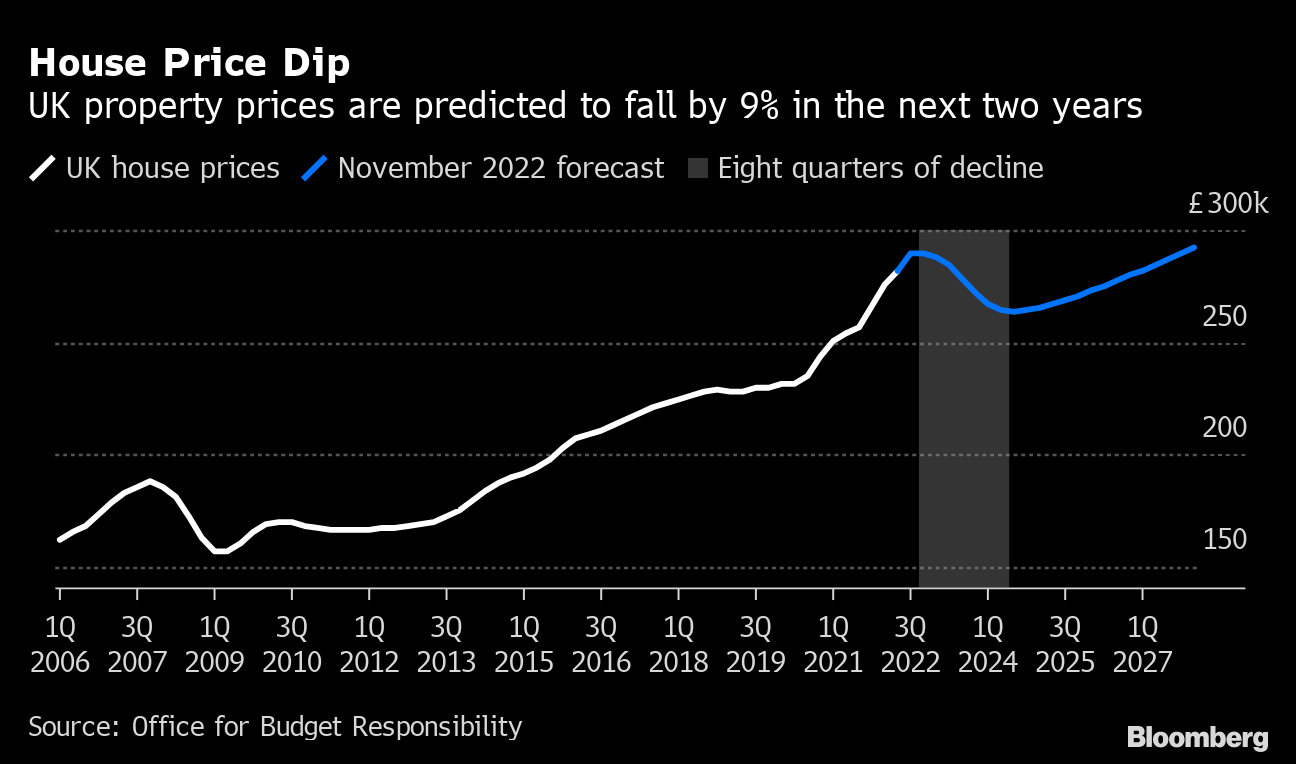

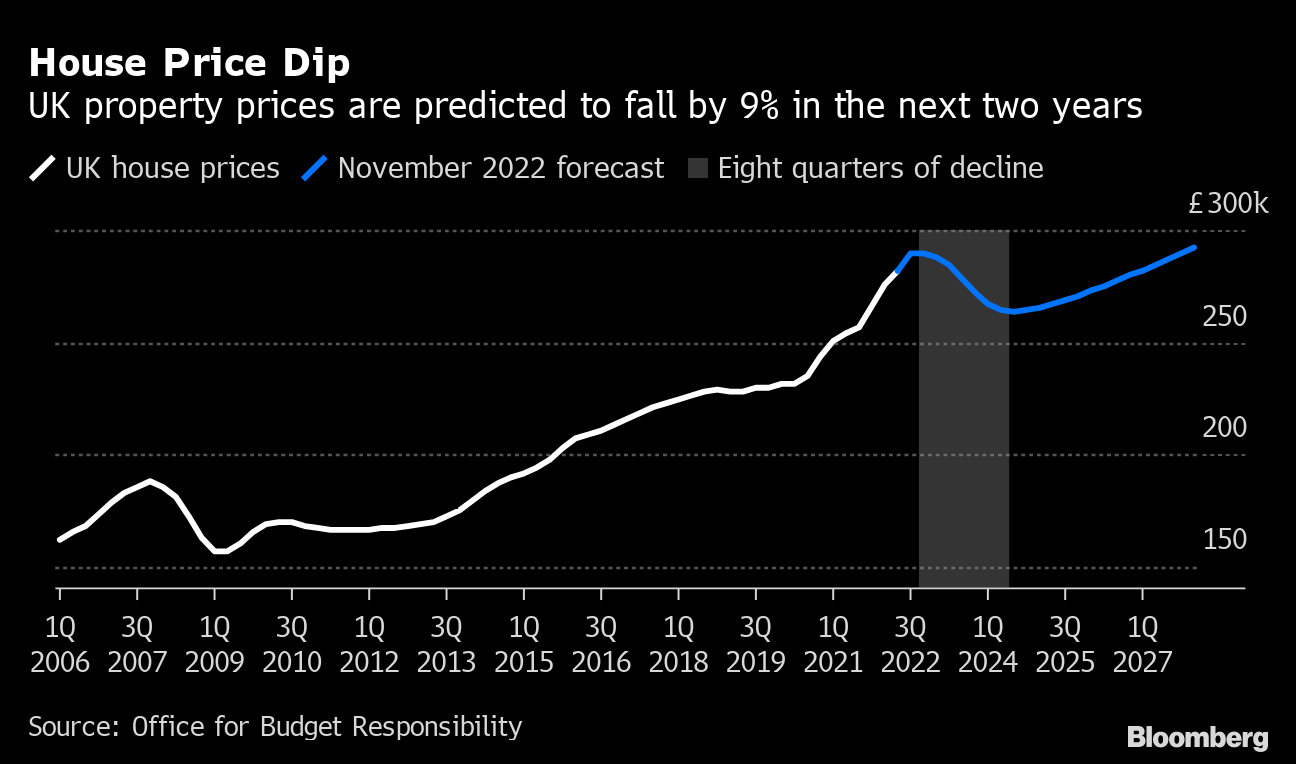

The expected rise in interest rates in 2025 has significant implications for investors and businesses:

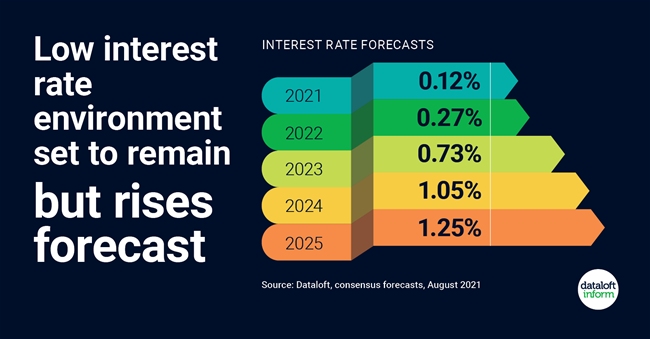

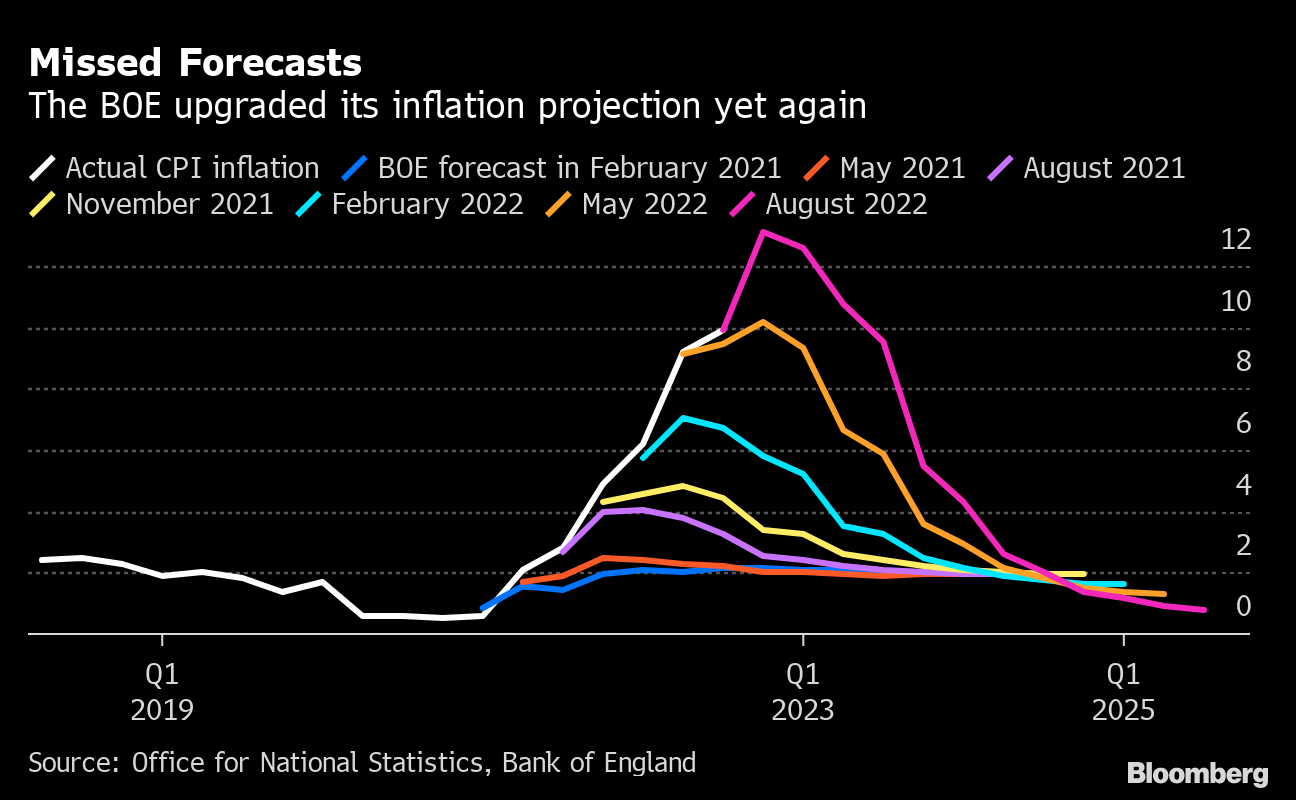

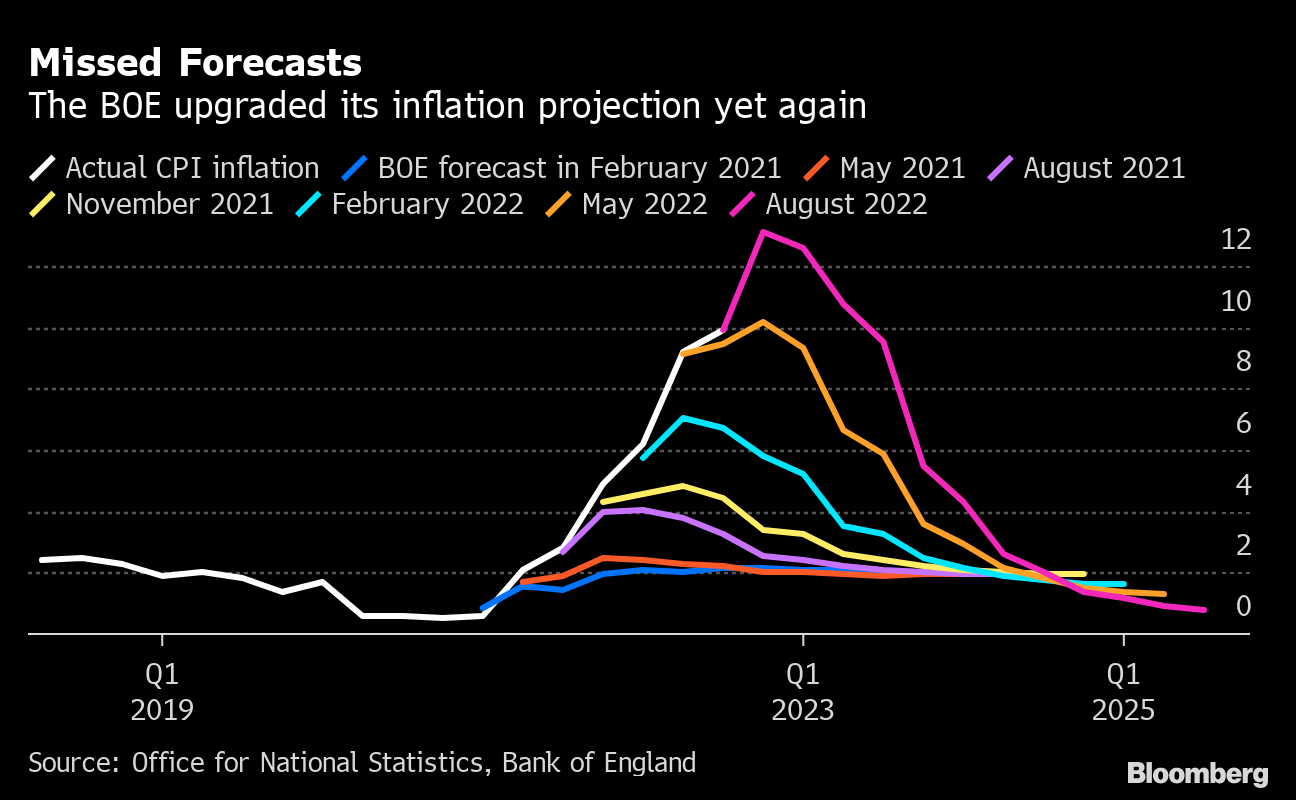

While the expected interest rate trajectory provides guidance, it is important to acknowledge potential risks and uncertainties:

The expected interest rate trajectory in 2025 is influenced by a complex interplay of economic factors and expert projections. While gradual increases are anticipated, risks and uncertainties remain. Investors and businesses should monitor economic developments and adjust their strategies accordingly. By understanding the potential interest rate environment, they can position themselves for success in the years ahead.

Thus, we hope this article has provided valuable insights into Expected Interest Rates in 2025: A Comprehensive Outlook. We hope you find this article informative and beneficial. See you in our next article!