2025 Gift Tax Exclusion Amount

Blog2025 Gift Tax Exclusion Amount. In other words, giving more than $19,000 to any individual in 2025 means you. The gift tax annual exclusion (also simply called the annual exclusion) was also changed in 2025 and will be increased to $19,000.

The irs recently announced increases in gift and estate tax exemptions for 2025. Regarding annual gifts, the current (2025) federal annual gift tax exclusion is $18,000.00 per u.s.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, The new (2025) federal annual gift.

2025 Annual Gift Tax Exclusion Nelli Libbie, The gift tax annual exclusion amount is set to increase from $18,000 per person in 2025 to $19,000 per person in 2025.

Gift Tax 2025 Exclusion Megan Bond, In addition to federal exemptions, new york state imposes its own estate tax with a separate.

2025 Lifetime Gift Tax Exclusion Amount Worksheet Edward Springer, Annual exclusion and lifetime gift limits for gifts made to individuals during their lifetime, the annual exclusion limit for 2025 is $19,000 per recipient.

Historical Estate Tax Exemption Amounts And Tax Rates, From january 1, 2025, rbi introduces revised regulations for fixed deposits from nbfcs and hfcs.

2025 Gift Amount Allowed William Bower, With this change, in 2025, an individual may gift up to $19,000 to an unlimited number of recipients without federal gift tax consequences (meaning the gifts do not consume.

2025 Annual Gift Tax Exclusion Nelli Libbie, In addition to federal exemptions, new york state imposes its own estate tax with a separate.

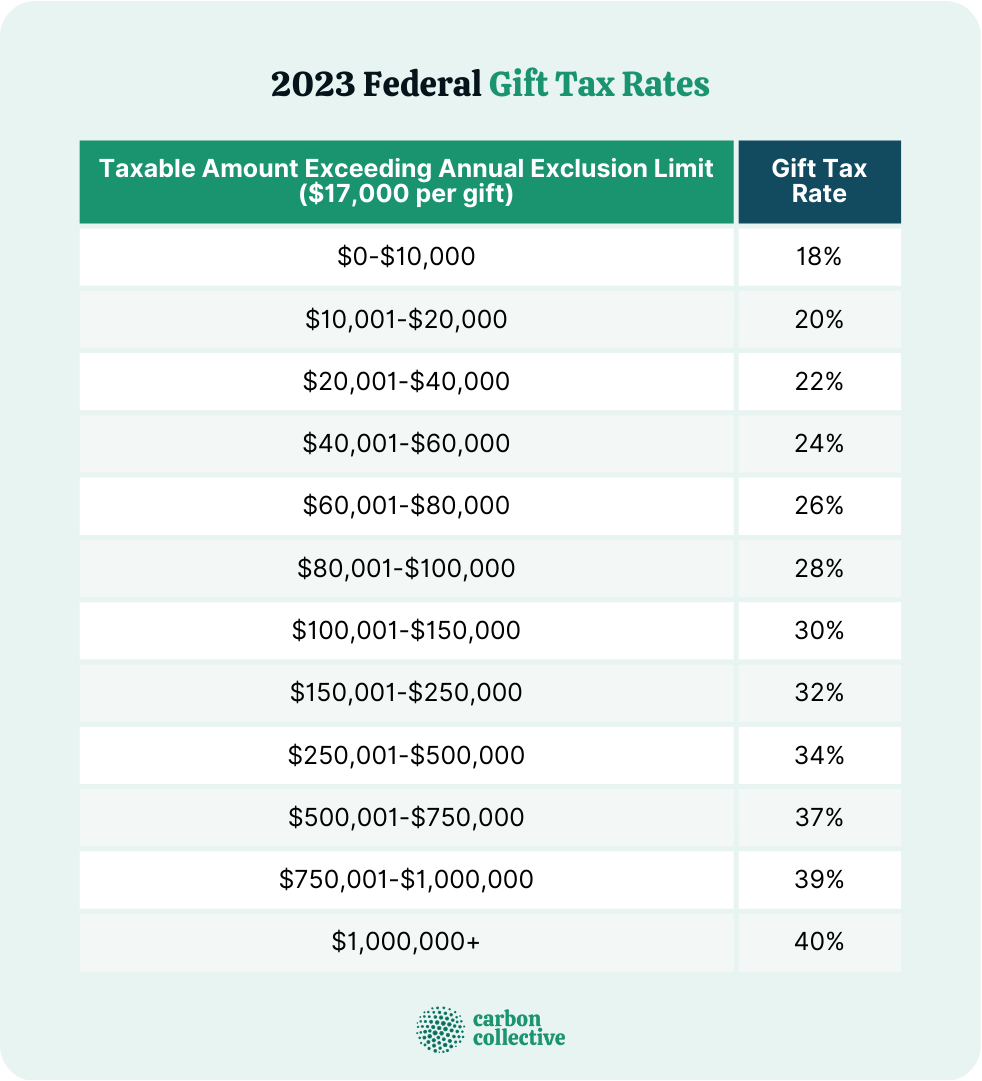

Irs Gift Exclusion 2025 Fiann Annabell, Speaking of the lifetime exemption, the estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2025.

Annual Gift Tax Limit 2025 Aleda Aundrea, In addition to federal exemptions, new york state imposes its own estate tax with a separate.