2025 Form 2210 Instructions

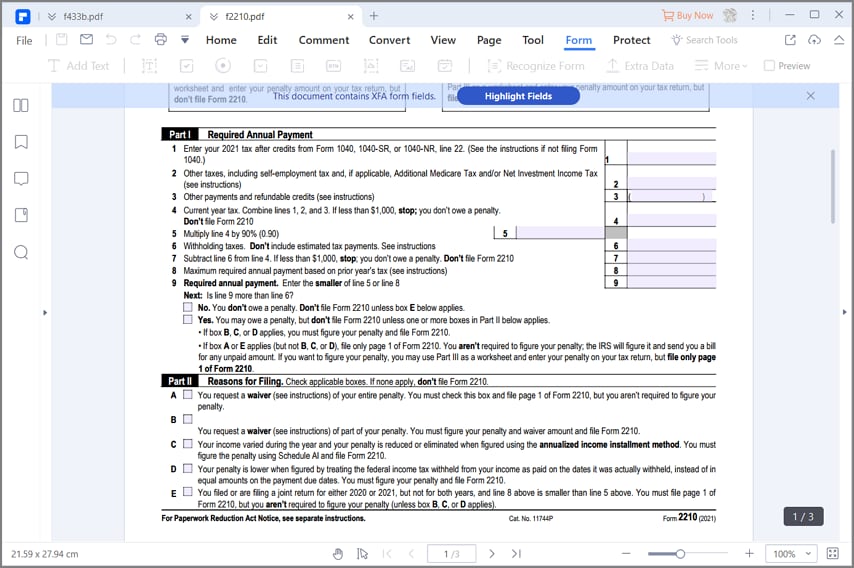

Blog2025 Form 2210 Instructions. What tax form do you use for the annualized income installment method? You request a waiver (see instructions) of your entire penalty.

Waiver (see instructions) of your entire penalty. Enter the estimated tax payments you made by january 15, 2025, and any alabama.

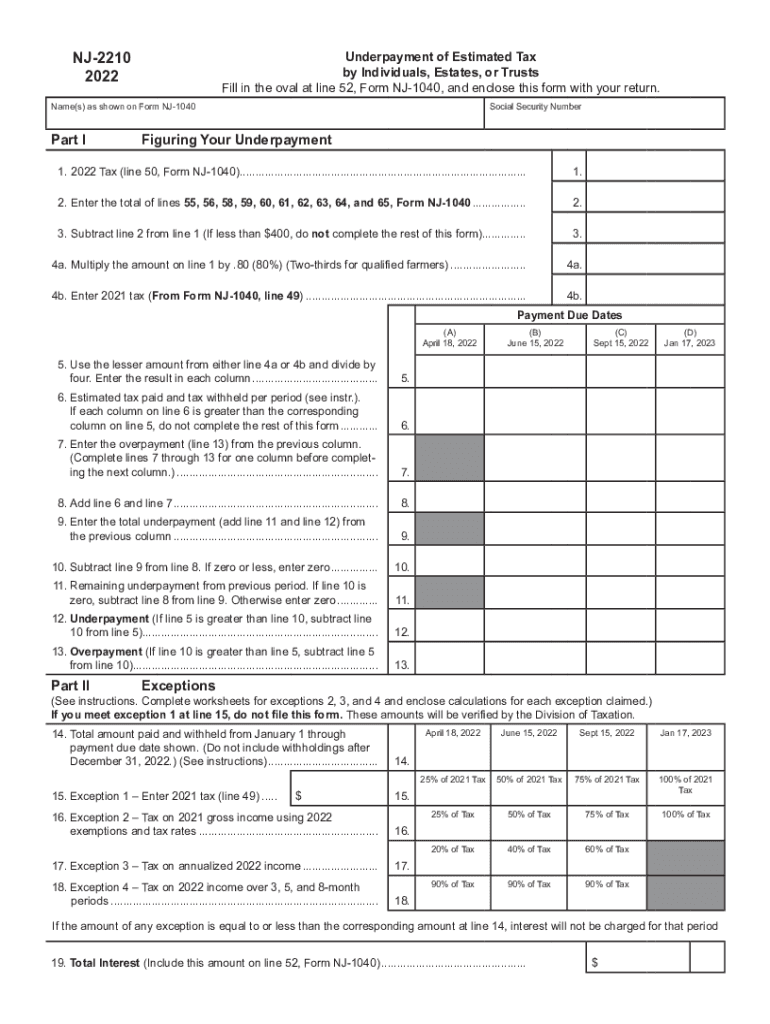

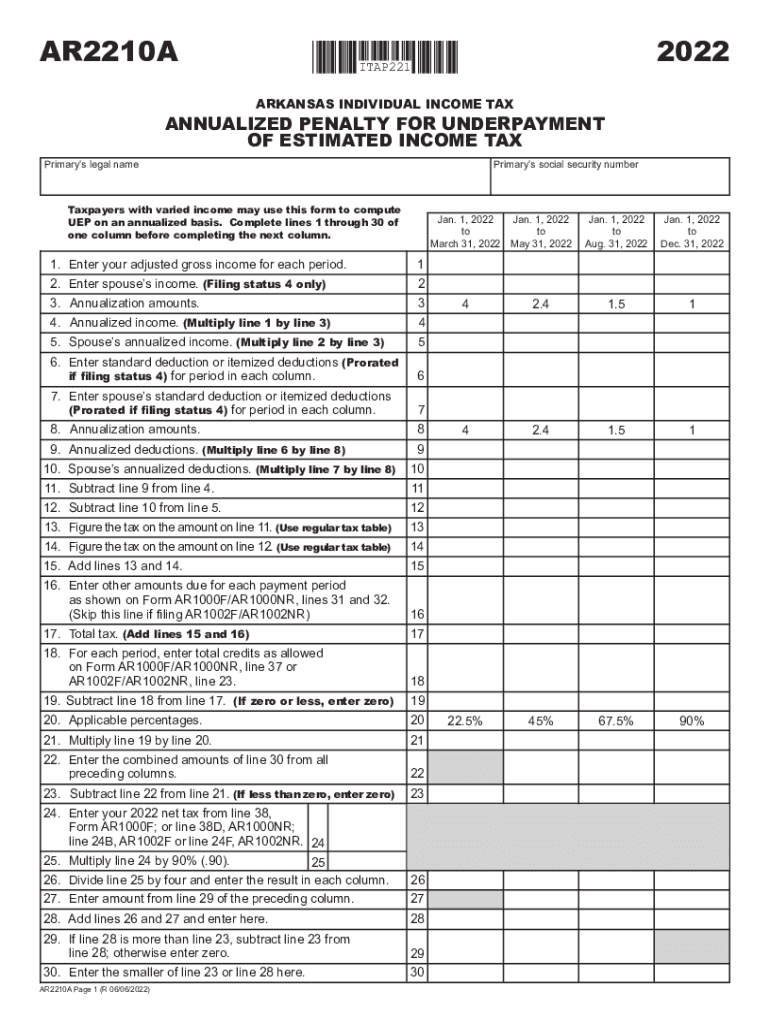

If your income was not evenly divided over 4 periods, see instructions on the reverse of this form on the “annualized income” method.

You had most of your income tax withheld early in the year instead of spreading it equally through the.

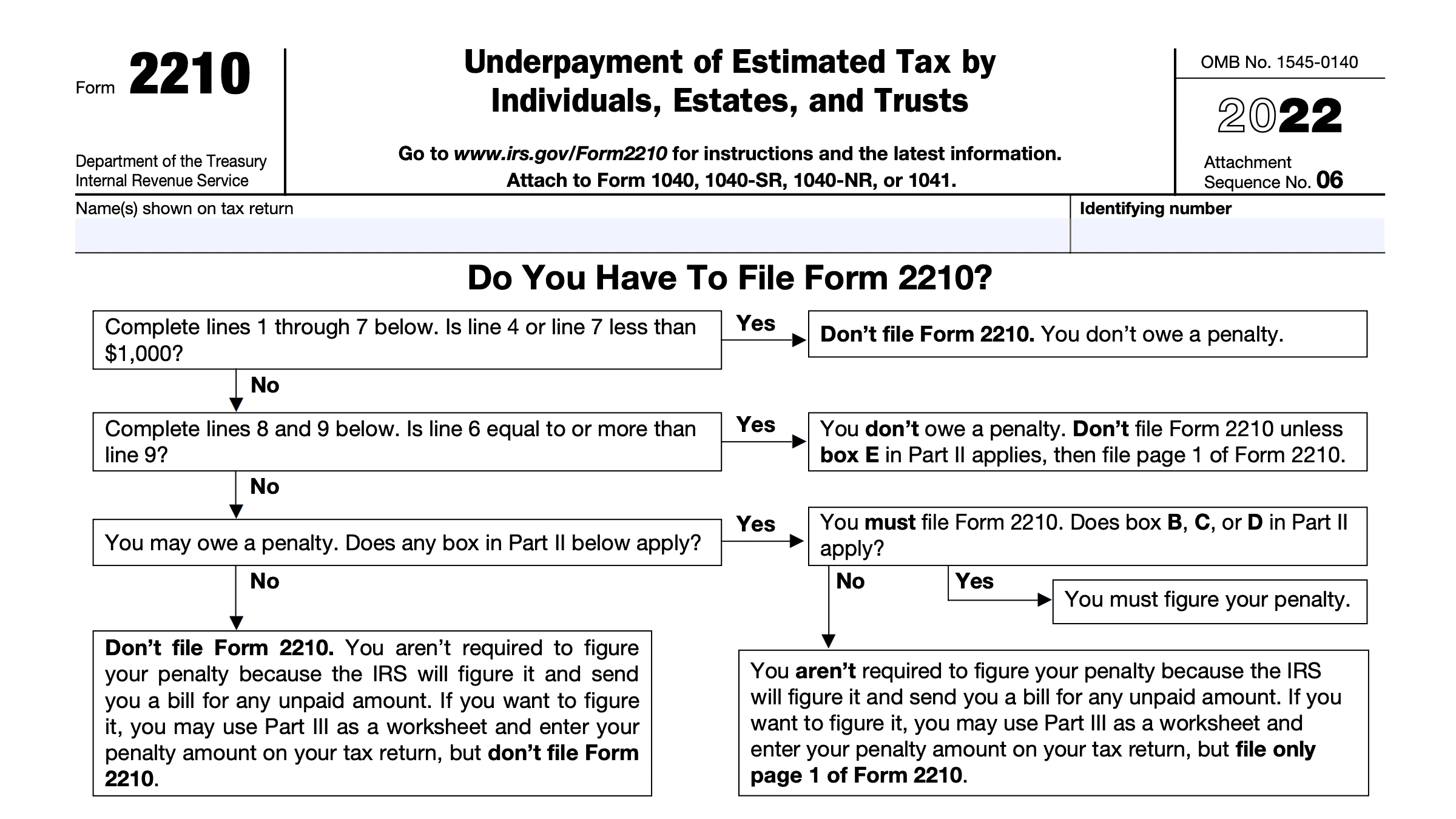

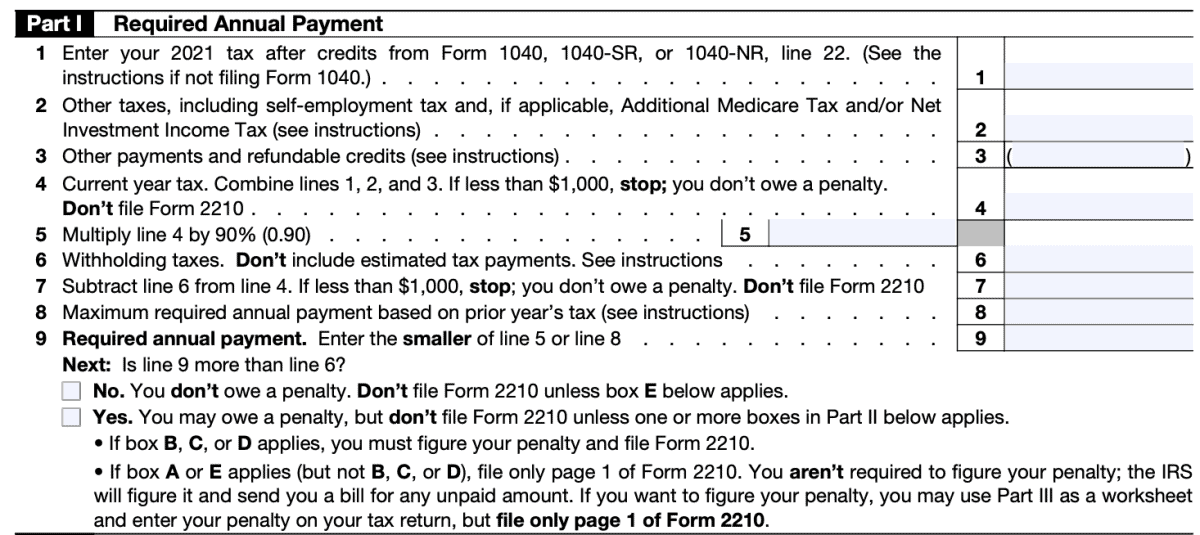

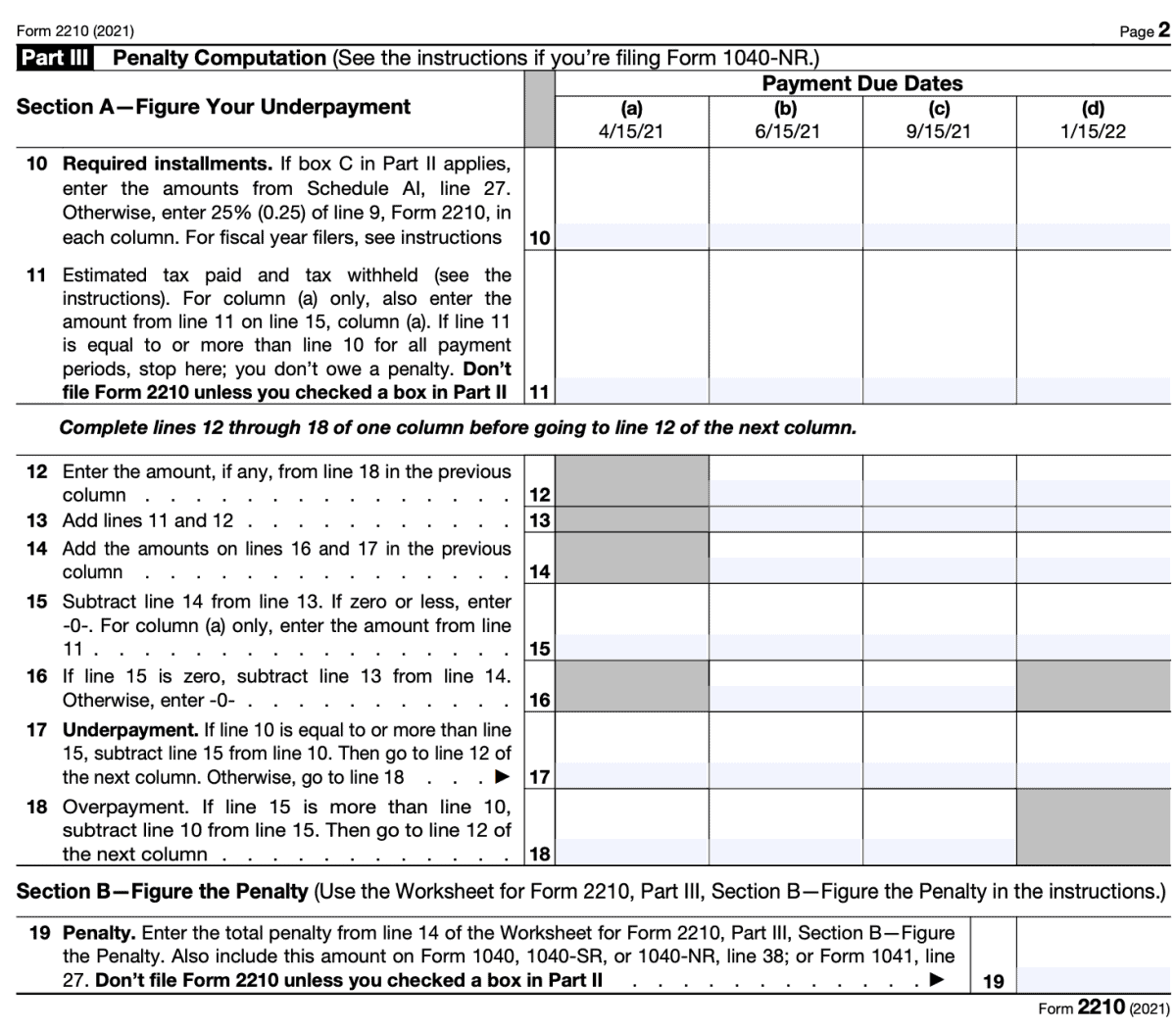

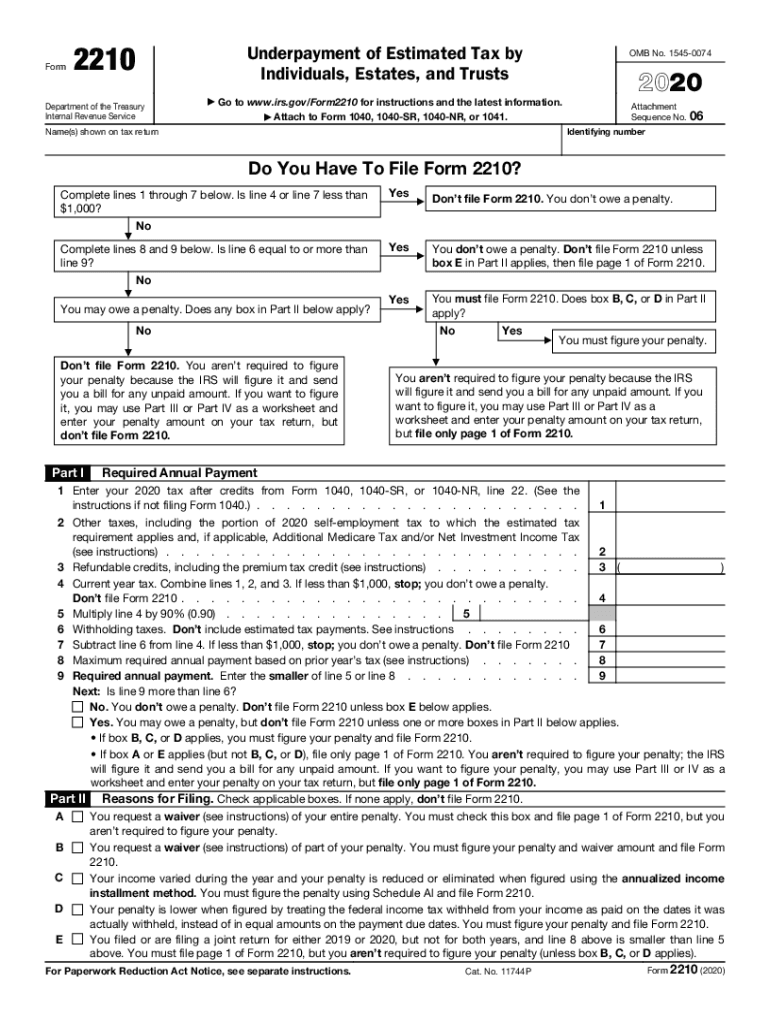

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax, This form computes penalty and interest for estimate vouchers to the date of payment or april 15, 2025, whichever is earlier. Do not owe a penalty and are not required to file form.

Download Instructions for IRS Form 2210F Underpayment of Estimated Tax, If you meet both tests 1 and 2 below, you don't owe a penalty for underpaying estimated tax. Enter the penalty on form 2210, line 19, and on the estimated tax penalty line on your tax return.

IRS Form 2210 Instructions Underpayment of Estimated Tax, If your income varied during the year because, for example, you oper. According to the form 2210 instructions:

2210 Form 2025 2025, Should not file form 2210. 6, 2025 — in an effort to provide more resources for taxpayers during this filing season, the internal revenue service today revised frequently asked questions for.

IRS Form 2210 A Guide to Underpayment of Tax, You had most of your income tax withheld early in the year instead of spreading it equally through the. 6, 2025 — in an effort to provide more resources for taxpayers during this filing season, the internal revenue service today revised frequently asked questions for.

IRS Form 2210 Instructions Underpayment of Estimated Tax, Additional penalty and additional penalty. If your income was not evenly divided over 4 periods, see instructions on the reverse of this form on the “annualized income” method.

2210 20222024 Form Fill Out and Sign Printable PDF Template signNow, If you meet both tests 1 and 2 below, you don't owe a penalty for underpaying estimated tax. Additional penalty and additional penalty.

Remplir le formulaire 2210 de l'IRS avec le meilleur remplisseur, This video briefly walks taxpayers through how to navigate schedule ai on irs form 2210. You’ll need to submit form 2210 to use this method.

Form 2210 Fill out & sign online DocHub, Should not file form 2210. According to the form 2210 instructions:

Form 2210 Fill out & sign online DocHub, This video briefly walks taxpayers through how to navigate schedule ai on irs form 2210. What tax form do you use for the annualized income installment method?